01 Jan US overtakes China as South Korea’s top export market for the first time in 2 decades in December

South Korean exports to the US exceeded shipments to China for the first time in two decades last month, in a sign of shifting ties amid global tensions over economic security and tech supply chains.

South Korea sold US$11.3 billion in goods to the US in December compared with US$10.9 billion to China, the trade ministry said on Monday. The switch in positions came as South Korea’s overall exports rose 5.1 per cent from a year earlier – a third monthly increase after a year-long slump.

The change in positions partly reflects China’s economic challenges, which led policymakers to come up with a series of stimulus measures last year. Still, one month’s data does not offer conclusive proof of a conscious or enduring shift in trading patterns.

China remains South Korea’s biggest trading partner by a large margin given the scale of Seoul’s imports from the world’s second-largest economy.

While exports to the US have increased from a year earlier for a fifth month, South Korea said shipments to China also continued to improve.

Meanwhile, South Korea’s overall imports declined 10.8 per cent from a year earlier, with a trade surplus widening to US$4.5 billion.

The data comes as the US looks to generate support for its agenda to reduce dependence on China in global supply chains and limit the country’s access to advanced semiconductor technology.

That has placed countries like South Korea and Japan in an awkward spot between their two biggest trading partners. Both Seoul and Tokyo are key military allies of Washington, another important dimension given Beijing’s increasing assertiveness in the Indo-Pacific and rising tensions in the region.

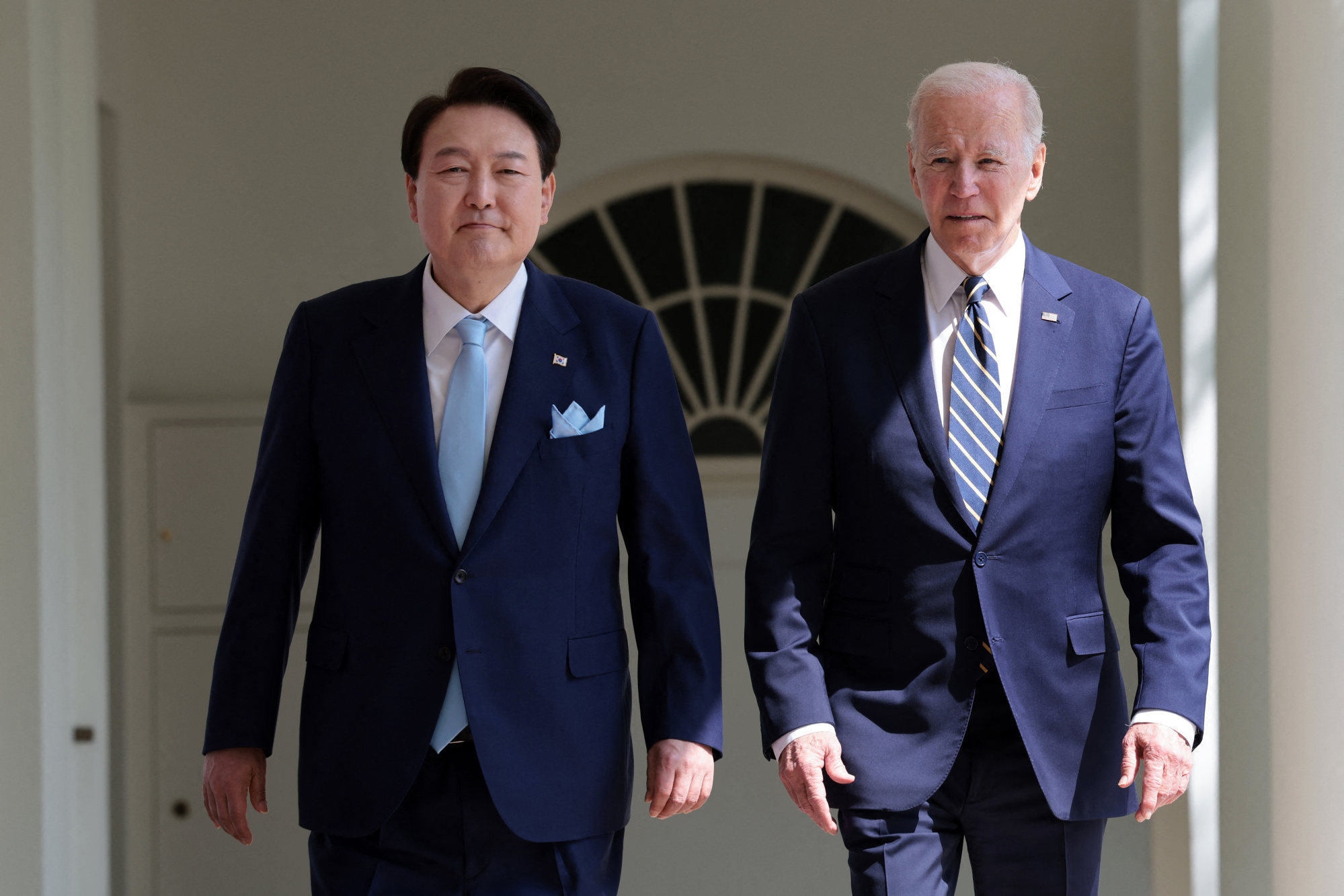

Under President Yoon Suk-yeol, South Korea has been forging stronger ties with the US. Yoon travelled to Washington last year with a plethora of Korean executives, where he pitched deeper ties with America in meetings with President Joe Biden and Congress.

South Korea and the US have a free-trade agreement which began in 2012, so Seoul benefits from US laws that increasingly restrict the use of batteries and other products made in countries including China.

China is also ramping up domestic production of goods as it moves up the value chain. One key area that China is focusing on is semiconductor and smartphone manufacturing, a development that has contributed to a slump in sales of goods made by Samsung Electronics and other businesses.