05 Jan Hong Kong-based AI-driven company sells potential breast cancer drug in deal whose value could exceed US$500 million

Stemline Therapeutics, a wholly owned unit of Menarini, will make a US$12 million upfront payment to Insilico under the agreement, which will be followed by sales royalties worth up to “double digits”. The combined value of the deal includes all development, regulatory, and commercial milestones.

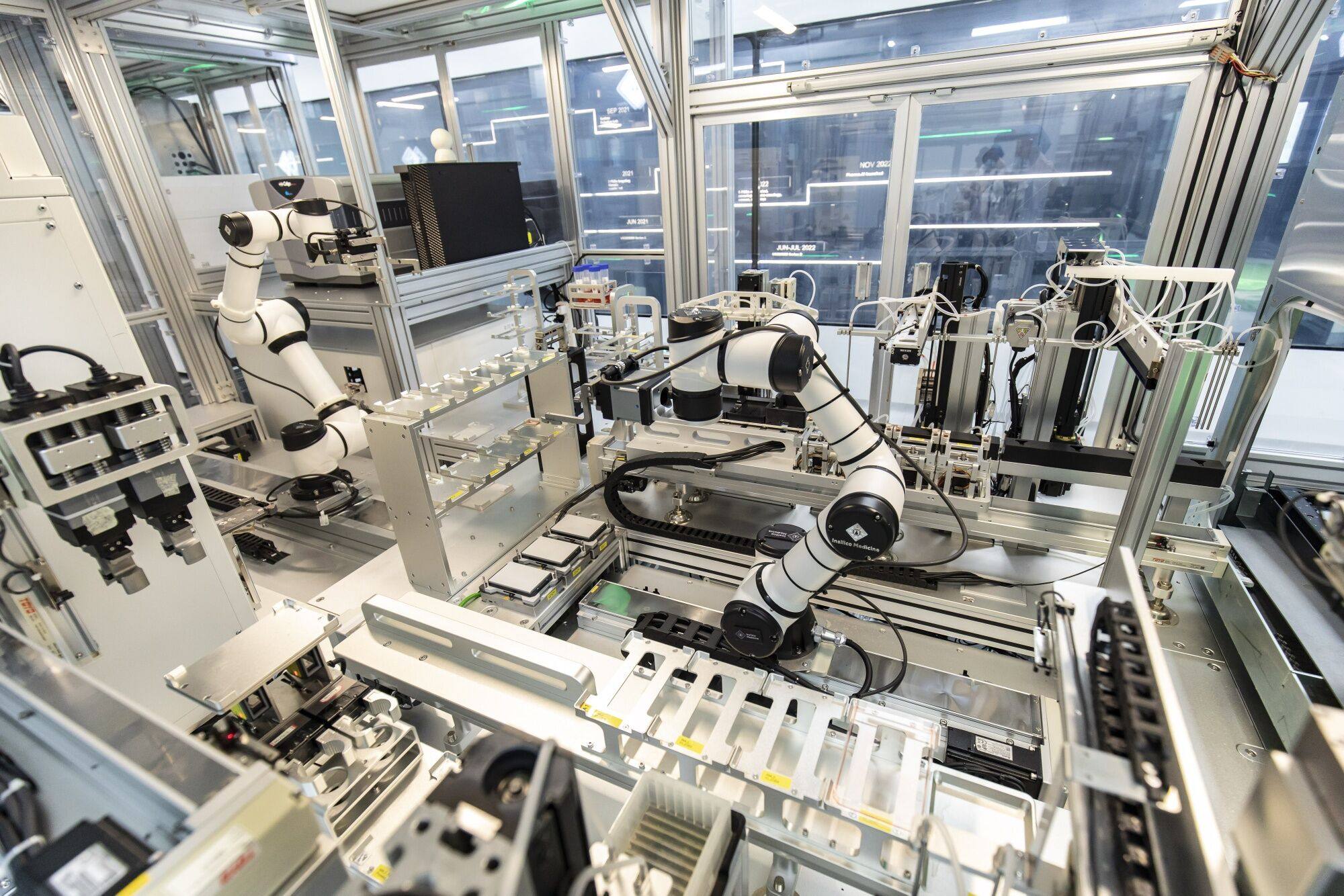

The agreement comes at a time when cutting-edge technology is playing a greater role in drug discovery. AI has emerged as a catalyst in revolutionising drug discovery by enhancing efficiency and accuracy while reducing the time-consuming aspects of research and development, experts say.

The AI-driven drug discovery market is projected to grow at a compound annual growth rate (CAGR) of 23.72 per cent from 2023 to 2030, reaching an estimated value of US$7.1 billion by 2030, according to US-based Vantage Market Research.

The technology expedites the process of identifying potential drugs, according to Insilico’s founder and co-CEO, Dr Alex Zhavoronkov.

Under the exclusive licensing agreement, Insilico has granted Stemline the global rights to develop and commercialise a novel small molecule KAT6A inhibitor as a potential treatment for hormone-sensitive cancers and other oncology indications.

Sanofi signs with Hong Kong biotech firm Insilico to spur AI drug discovery

Sanofi signs with Hong Kong biotech firm Insilico to spur AI drug discovery

Breast cancer is the most common cancer worldwide and the leading cause of cancer death among women, according to the World Health Organization.

The global breast cancer market is projected to hit around US$73.68 billion by 2032 with a registered CAGR of 9.9 per cent, according to Precedence Research.

“The partnership at the early stage preclinical trial is truly optimal when the partner is very committed,” said Zhavoronkov.

Menarini, an international pharmaceutical and diagnostics company with a turnover of more than US$4.4 billion and operations in 140 countries, sees the collaboration with Insilico as an opportunity to explore new treatment approaches and potentially unlock transformative cancer therapies, according to CEO Elcin Barker Ergun.

Insilico, founded by Zhavoronkov in 2014, has a pipeline that consists of 31 programmes for 29 drug targets in cancer, fibrosis, immunity, central nervous system and ageing-related diseases.

In June last year, the company revealed an IPO plan in Hong Kong after shelving a New York fundraising plan, to fund clinical trials of drugs discovered and designed by artificial intelligence.

Zhavoronkov declined to reveal a timeline for its IPO but said market sentiment was a concern.

Insilico has a presence in the markets of the US, Greater China, Canada and the Middle East. It launched the Generative AI and Quantum Computing Research and Development Center in Abu Dhabi in February 2023.

To date, the company has raised more than US$400 million via private markets. In 2022, it secured series D financing of US$95 million from investors such as Prosperity7, a growth venture fund of Saudi Arabia’s Aramco, and others including B Capital Group, Warburg Pincus, and Hong Kong-based Qiming Ventures.