04 Apr Home-grown hydrogen energy start-up Epago aims to tap Hong Kong’s innovation ecosystem to expand to China and overseas

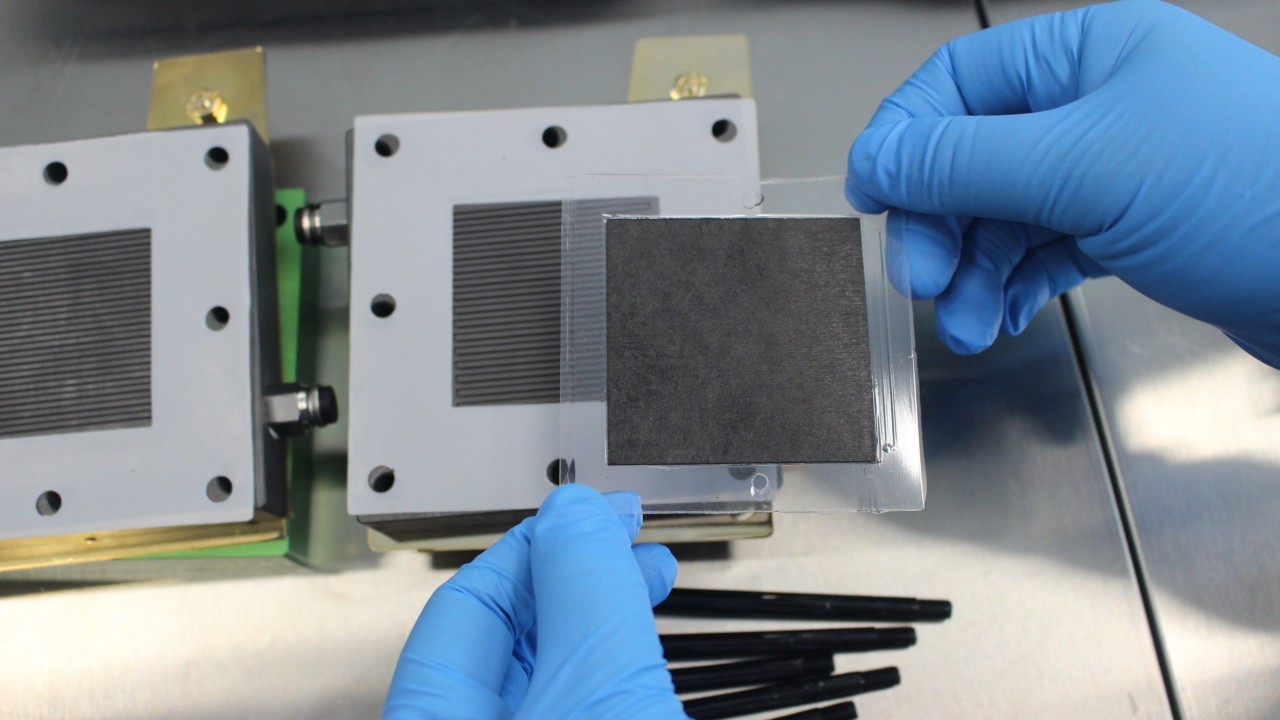

Having started out as a research project looking at fuel cell electrodes at HKSTP, the company has developed a new structure of membrane electrode assemblies (MEA), the most critical component of hydrogen fuel cell batteries which makes it possible to convert hydrogen into electricity.

Because of its complicated structure and use of expensive platinum as a catalyst, MEA accounts for around half of the cost of a hydrogen fuel cell stack, and requires a huge amount of energy during the production process.

Using patented technology developed by its team from Hong Kong University and the California Institute of Technology, Epago is able to restructure the MEA in fuel cells to save up to 80 per cent on the production costs and make the manufacturing process five times faster, according to Zhu Haoyu, co-founder and chief technology officer at Epago.

Epago signed an agreement with the city government of Wuxi in Jiangsu province in February last year, under which the city will provide manpower, access to production facilities, and tax breaks to the company for their development in mainland China.

The company is seeking to raise HK$15 million by the end of May, and has HK$$5.4 million already committed and another HK$2.5 million under discussion.

It is planning to set up a prototype production line in Italy later this year, and begin series A fundraising and expand its manufacturing base to mainland China next year.

With current production capacity at the laboratory scale, Epago is planning to reach a cumulative output of 30,000 square metres of electrodes in five years, once it has expanded its client base to China, Japan, Italy, Germany and France.

“Hong Kong will forever be the R&D and prototype centre, but it’s limited in large-scale industrial capability due to the land and costs,” said Grippi.

Epago expects to leverage Hong Kong’s unique position in the Greater Bay Area to tap China’s low production costs and sophisticated supply chain. It is currently in talks with the city government of Foshan in Guangdong province about future partnerships.

“China has a plan that’s very ambitious and realistic in developing its hydrogen economy,” said Grippi. “We’ve found ourselves in a very good moment in time where we have the technology, the vision to bring a change, and we are in a place where there are the resources for the innovation to come to life.”

China, already the world’s largest producer of hydrogen, sees the clean fuel as one of the new vehicles for nurturing nascent technologies and industries, on top of advancements in solar power, wind farms, electric vehicles, lithium batteries and the electrification of transport.

In 2022, the country introduced its first ever national hydrogen strategy – a medium and long-term plan for the development of the hydrogen energy industry between 2021 and 2035. Under this, China aims to have at least 50,000 hydrogen fuel-cell electric vehicles on the road and produce 100,000 to 200,000 tonnes of “green hydrogen” – hydrogen produced using electricity generated by renewable resources – annually by 2025.