05 Apr Cambridge Associates looks to help investors tap into Asia’s growing potential for building wealth

Disclaimer: Discretionary portfolio management services, also known as Outsourced Chief Investment Officer (OCIO), are not available in Hong Kong and are only available in locations where Cambridge Associates is licensed to provide such services.

Cambridge Associates, the US-headquartered global investment firm, has built its reputation by offering services that include discretionary and non-discretionary portfolio management, as well as alternative asset class mandates for private clients, endowments and foundations, pension funds and other types of sophisticated investors.

With more than 50 years’ experience globally in handling institutional and family office investments, Cambridge Associates has extensive know-how in reading market trends and identifying strategic opportunities to increase wealth over the long term.

“When working with clients, our philosophy is to build diversified portfolios because diversification actually mitigates some of the uncertainty or variability in the markets,” says David Druley, CEO of Cambridge Associates.

The firm opened its Hong Kong office in 2021, expanding its presence in Asia alongside operations in Beijing and Singapore. Headquartered in Boston, Cambridge Associates also has offices in key markets in North America, the United Kingdom, Europe and Oceania.

With mixed signals about the prospects for global economic growth and related returns this year and beyond, there is a clear need for trusted professional advisers who can tailor portfolios to meet specific investment goals amid market volatility.

This increasingly complex and competitive investment landscape is why Cambridge Associates is seeing an increase in demand for its Outsourced Chief Investment Officer (OCIO), or discretionary portfolio management services, from investors globally and in Asia, which makes it possible for asset owners to delegate investment decision-making, while simultaneously tapping into the collective wisdom of Cambridge Associates’ team of professionals, drawing on their accumulated years of market insight and experience.

“We believe one of the unique aspects of Cambridge Associates is we globally have close to 300 senior investment professionals, who have an average of almost 20 years of investment experience,” Druley says.

OCIO can be considered akin to having your own dedicated investment office that can supervise and execute portfolio strategies, suggest new areas of investment, anticipate risks and take prompt actions. And, crucially, the services are geared to address clients’ specific needs and find ways to outperform benchmarks.

Druley explains: “Since each client has a unique set of risk-and-return objectives, our OCIO teams partner very closely with them to create bespoke portfolios to meet those long-term needs. We are transparent about the decisions that we make on behalf of our clients and accountable for performance.”

At Cambridge Associates, he adds, the focus is on finding best-in-class global investment managers for different asset classes and instruments that go into clients’ portfolios, which are built as separately managed accounts. This means their clients own the investments and the relationships with the managers that the firm invests in.

This is unlike the situation in which portfolios are implemented in multi-client pooling products that limit other OCIOs’ ability to customise, thus requiring limited partners to liquidate their holdings if they change investment partners.

“As OCIOs, we want to help clients take advantage of market dislocation opportunities that can arise,” Druley says. “But we start by agreeing on the strategic parameters of what they’re going to do, their risk tolerance and what returns they are trying to achieve. Then they outsource day-to-day decisions to us, and we report back regularly.”

That approach depends on good communication, the analysis and ideas of an in-house capital markets research group, and the execution carried out by a team of senior investment professionals.

It is a model that has proven to work well for private clients, family offices and institutional investors around the world, and Druley sees plenty of potential for Cambridge Associates to further expand in Asia in the years ahead.

His optimism is based on several factors. There is the underlying strength of the region’s economy, the ongoing generational transfer of wealth, the diversity of emerging markets and industries, and the interest in balancing responsible investing with impact investing.

“In particular, we see that family offices in Asia are ‘institutionalising’, and we’re partnering with them to do that either through an OCIO relationship or by working with their staff to implement portfolios,” Druley says.

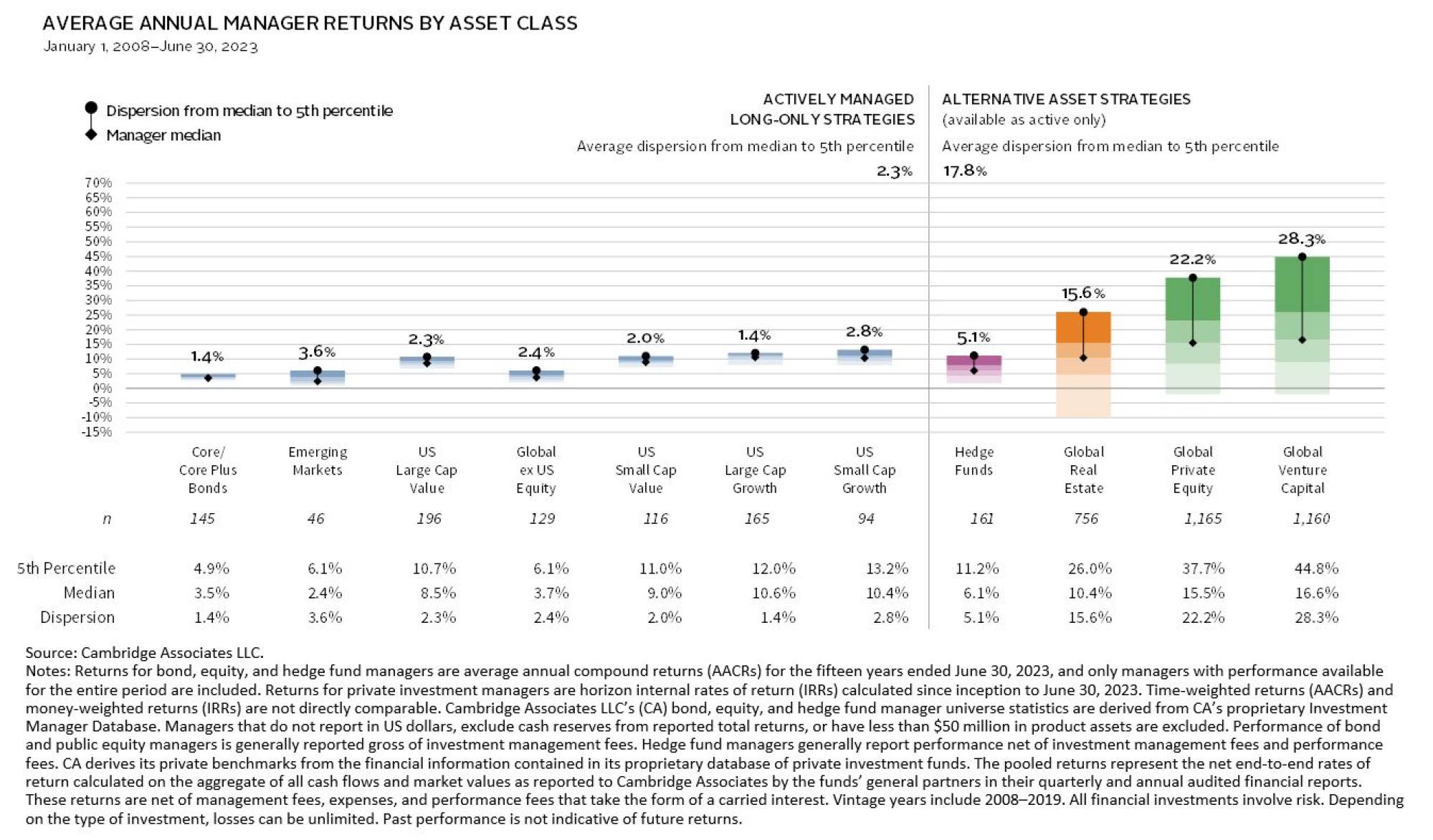

“Typically, they want help diversifying their assets across the globe to mitigate country risk. Also, the more sophisticated family offices are now investing in private equity, venture capital and hedge funds where, if you don’t have the experienced professional talent to do it, the difference between mediocrity and success is massive.”

Over the past five years, Cambridge Associates has recorded an average client retention rate of 96 per cent.

“We don’t create a model that is only good for us and then try to sell it to the client,” says Druley, who is set to make a trip to Asia, visiting Singapore, India and Hong Kong to connect with clients, prospects and industry leaders.

“We understand what the wealth owners are trying to achieve up front and how their thinking evolves, so we are able to adapt their strategy.”

Druley emphasises that in order to do this, it is vital for the firm’s team of investment professionals to be part of the network of great ideas. That means being up to date with the latest developments in areas ranging from commodity prices and real estate to the green economy. It also means being able to spot inefficiencies in a market.

“This is all a judgment game, and that’s why we have people with experience, which I think differentiates us,” Druley says.

“We also notice the younger generation of wealth owners – whether in Europe, the US or Asia – want to do good in the world while they are investing. And we can help them achieve their aspirations.”

Disclaimer from Cambridge Associates:

The terms “CA” or “Cambridge Associates” refers to the Cambridge Associates Group of companies: Cambridge Associates, LLC (a registered investment adviser with the US Securities and Exchange Commission, a Commodity Trading Adviser registered with the US Commodity Futures Trading Commission and National Futures Association, and a Massachusetts limited liability company with offices in Arlington, VA; Boston, MA; Dallas, TX; New York, NY; and San Francisco, CA), Cambridge Associates Limited (a registered limited company in England and Wales, No. 06135829, that is authorised and regulated by the UK Financial Conduct Authority in the conduct of Investment Business, reference number: 474331); Cambridge Associates GmbH (authorised and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (‘BaFin’), Identification Number: 155510), Cambridge Associates Asia Pte Ltd (a Singapore corporation, registration No. 200101063G, which holds a Capital Market Services Licence to conduct Fund Management for Accredited and/or Institutional Investors only by the Monetary Authority of Singapore), Cambridge Associates Limited, LLC (a registered investment adviser with the US Securities and Exchange Commission, an Exempt Market Dealer and Portfolio Manager in the Canadian provinces of Alberta, British Columbia, Manitoba, Newfoundland and Labrador, Nova Scotia, Ontario, Québec, and Saskatchewan, and a Massachusetts limited liability company with a branch office in Sydney, Australia, ARBN 109 366 654), Cambridge Associates Investment Consultancy (Beijing) Ltd (a wholly owned subsidiary of Cambridge Associates, LLC which is registered with the Beijing Administration for Industry and Commerce, registration No. 110000450174972), and Cambridge Associates (Hong Kong) Private Limited (a Hong Kong private limited company licensed by the Securities and Futures Commission of Hong Kong to conduct the regulated activity of advising on securities to professional investors).