26 Mar 10 months and counting: Hong Kong home prices worsen in February to the lowest level since September 2016

The price decline last month preceded the government’s lifting of all property cooling measures amid slower than expected economic growth and a high-interest rate environment that has dented demand for property.

“Factors such as high interest rates, insufficient purchasing power and backlog of listings have caused property prices to continue to decline,” said Martin Wong, director and head of research and consultancy for Greater China at Knight Frank. “In the short term, second-hand property prices will continue to weaken due to the impact of primary sales.”

The price trend for secondary homes is likely to be “L-shaped”, Wong said, adding that he expects prices to decline 3 per cent to 5 per cent in the first half of the year before stabilising in the second half.

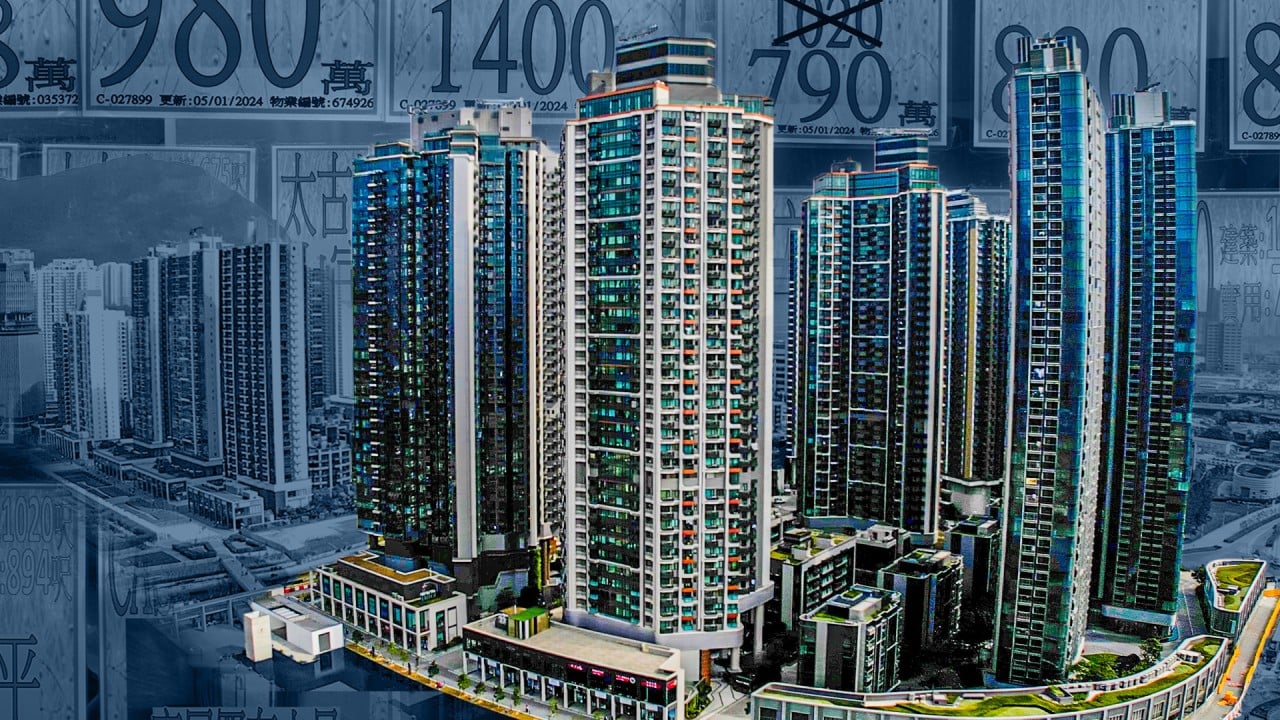

On Saturday, Wheelock Properties sold all 368 units on offer at Seasons Place in Tseung Kwan O. The developer priced the flats at a five-year low for the district, aligning with peers who continue to offer discounts to woo buyers after the government’s policy stimulus.

With the Federal Reserve taking longer than anticipated to lower interest rates, the rate cuts in Hong Kong consequently will be delayed, likely until the second half of the year, Wong said.

Financial Secretary Paul Chan Mo-po scrapped all cooling measures restricting property transactions in his budget on February 28, with the aim of restoring the city’s flagging fiscal health, and addressing mounting calls from the property and business sectors to ditch the decade-old measures.

The scrapped measures included the Buyer’s Stamp Duty that targeted non-permanent residents and a New Residential Stamp Duty for second-time purchasers. Homeowners also no longer need to pay a Special Stamp Duty if they sell their homes within two years.

The Hong Kong Mortgage Authority followed suit with its own easing measures. Homes valued at less than HK$30 million (US$3.8 million) are now eligible for 70 per cent mortgage financing, compared with the previous cap of 60 per cent for flats valued between HK$15 million and HK$30 million.

Mainland Chinese buyers have returned to the market, snapping up a greater proportion of new luxury homes worth HK$30 million or more since the removal of the property curbs, according to property consultancy JLL.

They accounted for 70 per cent of new luxury units this month, rebounding from less than 50 per cent earlier.