09 Mar At Leap 2024, Hong Kong start-ups and investors lay groundwork to tap future Saudi Arabia growth

“Because [the UAE is] so mature now, it’s actually quite difficult to penetrate the relationships with the top brass and the business leaders,” the British investor added. “Whereas in Saudi, they’re … a little bit after the beginning, and this is the best time to come. So the next 10-15 years in Saudi is a golden period for them, and also for investors.”

Hong Kong start-up hubs expand city’s collaboration with Saudi Arabia

Hong Kong start-up hubs expand city’s collaboration with Saudi Arabia

Leap 2024 also marked the first year to host a pavilion dedicated to Hong Kong start-ups. Attendees there noted the potential of the Saudi market as the main driver of their interest rather than any material benefits they might realise today.

“It’s definitely a market we’re looking to move into with both Preface and Prolog,” Laverick added. “So it’s really a case of coming here, trying to get a lay of the land a bit, meet some people, and start building those relationships.”

For a company like Prolog, Dubai in the UAE would make more sense as a regional headquarters. The city has become a major global Web3 hub, attracting some cryptocurrency entrepreneurs previously chased out of mainland China.

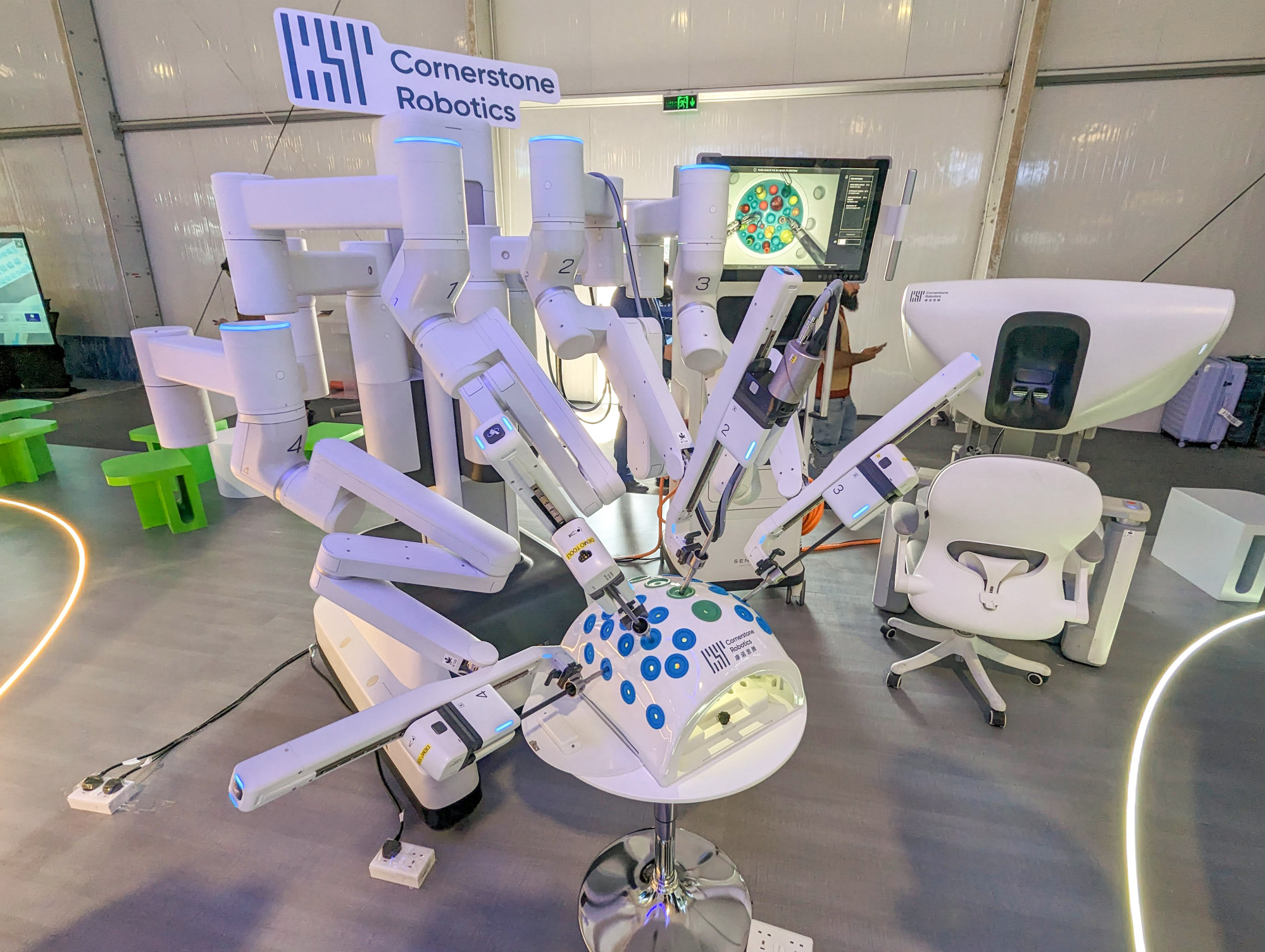

Cornerstone Robotics, an HKSTP company that makes a surgical robot offering surgeons greater precision in primarily abdominal procedures, is making inroads in mainland China, where it expects to get regulatory approval for medical use by the middle of this year.

Stuart Moran, Cornerstone’s director of clinical development, said the company was just exploring opportunities in the Middle East, including in Dubai and Abu Dhabi. However, he noted that the company hoped to find funding and partnership opportunities in Saudi Arabia.

“We did expect to get some leads on investment and of course there may be some down the line and linkage in Saudi Arabia,” Moran said. “We know they’re changing their economy dramatically. So we know there’s funding there, some interest there, maybe some JV [joint venture] down the line.”

The ties to China could play a critical role in Saudi Arabia’s ability to scale its economy to the level of the UAE. While the Saudi economy is nominally the largest in the Middle East, it lags far behind some of its neighbours in gross domestic product (GDP) per capita and foreign direct investment (FDI).

In 2022, the last year for which data is available from the World Bank, the UAE saw US$22.7 billion in FDI compared with US$7.9 billion in Saudi Arabia. GDP per capita was US$53,708 and US$30,448 for those countries, respectively, in the same year.

Held in a new convention centre more than 70km north of the Riyadh city centre, taking two to three hours by car in traffic, the event’s logistical issues also put the market’s growing pains on international display. The situation led to grumblings among attendees and even some negative attention in Chinese articles on WeChat.

Even in India, widely considered the next big growth market globally, Chinese tech giants have faced a difficult time amid tensions between New Delhi and Beijing. That makes Saudi Arabia look even more appealing to Chinese firms, as there are few rapidly growing markets left where they are likely to stand as equals beside Silicon Valley rivals.