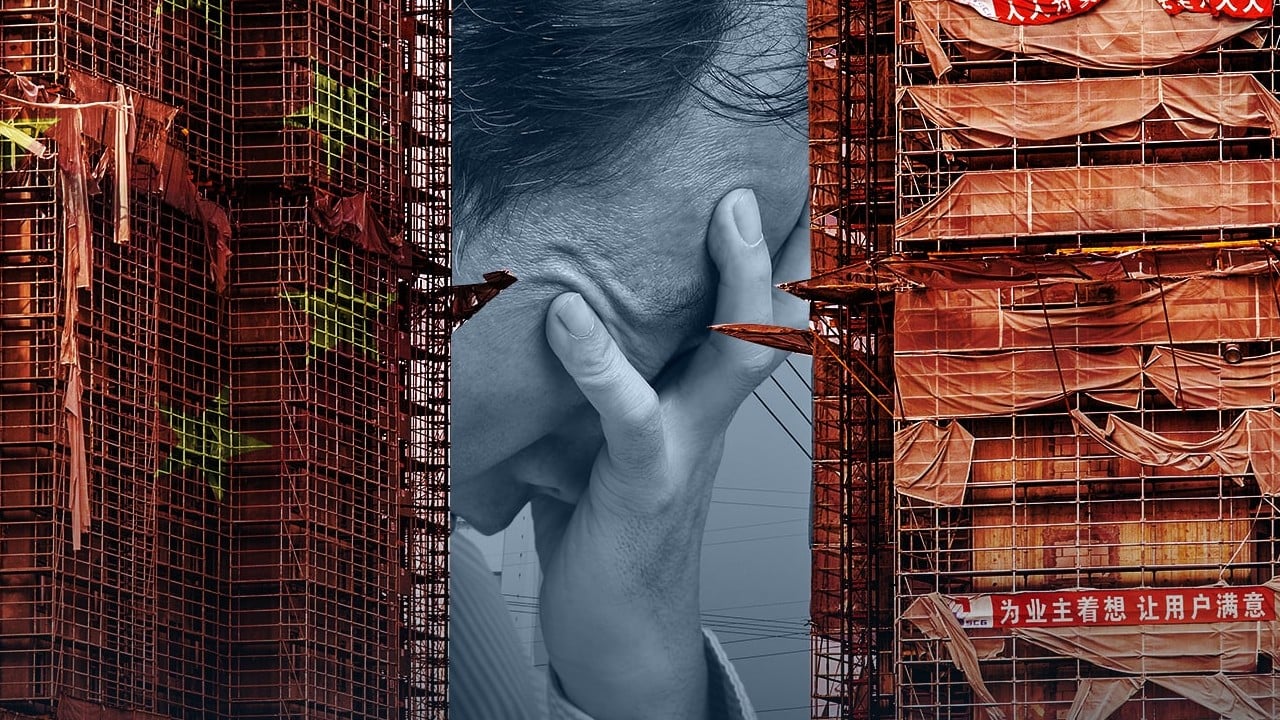

11 Jan China Resources Land reports slowest sales growth since 2015 amid housing slump while rental assets mitigate slowdown

The firm sold 307 billion yuan (US$42.7 billion) worth of homes last year, a 2 per cent annual increase, according to a Hong Kong stock exchange filing on Thursday. Sales in December slumped 58 per cent to 21 billion yuan from a year ago, it said.

The east China region was the biggest contributor to sales last year with 87.6 billion yuan, or about a 29 per cent share, it said, while north China provided 52.1 billion yuan and the west China region at 41.96 billion yuan. In Hong Kong, the developer had 3.9 billion yuan worth of sales, the filing showed. The company did not provide comparative 2022 data.

“The real estate industry, having experienced scalable and rapid development characterised by high debt, high leverage, and high turnover in the past, has undergone significant changes in market supply and demand dynamics,” chairman Li Xin said in the filing. This resulted in diverging sales performances across cities and varied customer behaviour, posing new challenges to the industry, he added.

The company’s shares closed 1 per cent higher at HK$26.05 in Hong Kong, while the broader market halted a seven-day slump. China Resources commands about 0.9 per cent weight in the Hang Seng Index, the third largest property member after Sun Hung Kai Properties and Link Reit.

The Shenzhen-based developer said rental income rose by about 40 per cent in December to 2.54 billion yuan, helping end the year with a 39 per cent gain.

Asia’s junk bonds are making a comeback while China property debt flounders

Asia’s junk bonds are making a comeback while China property debt flounders

Earnings at China Resources Land jumped almost 30 per cent to 13.7 billion yuan in the first half of 2023, making it one of the handful of mainland-based builders to keep shareholders happy while the property crisis triggered an unprecedented amount of debt defaults in the world’s second-largest economy.

The firm earlier declared an interim dividend of 0.198 yuan per share, versus 0.182 yuan in the first half of 2022.

The group is keeping to its strategic positioning as an “urban investment, development, and operation company” and strengthening its “3+1” business model by focusing on cost reduction, quality improvement, and efficiency to overcome the market slowdown, Li said.

It recently teamed up with Hong Kong developer New World Development on a Northern Metropolis project. As part of its joint-venture commitment, China Resources Land will invest in a plot of land owned by New World Development, sources familiar with the plan told the Post.

The site, covering an area of around 150,000 square feet in the southern part of Yuen Long, is expected to be developed into some 2,000 housing units. The total value of the development is expected to be HK$10 billion (US$1.28 billion) upon completion, one of the sources said.