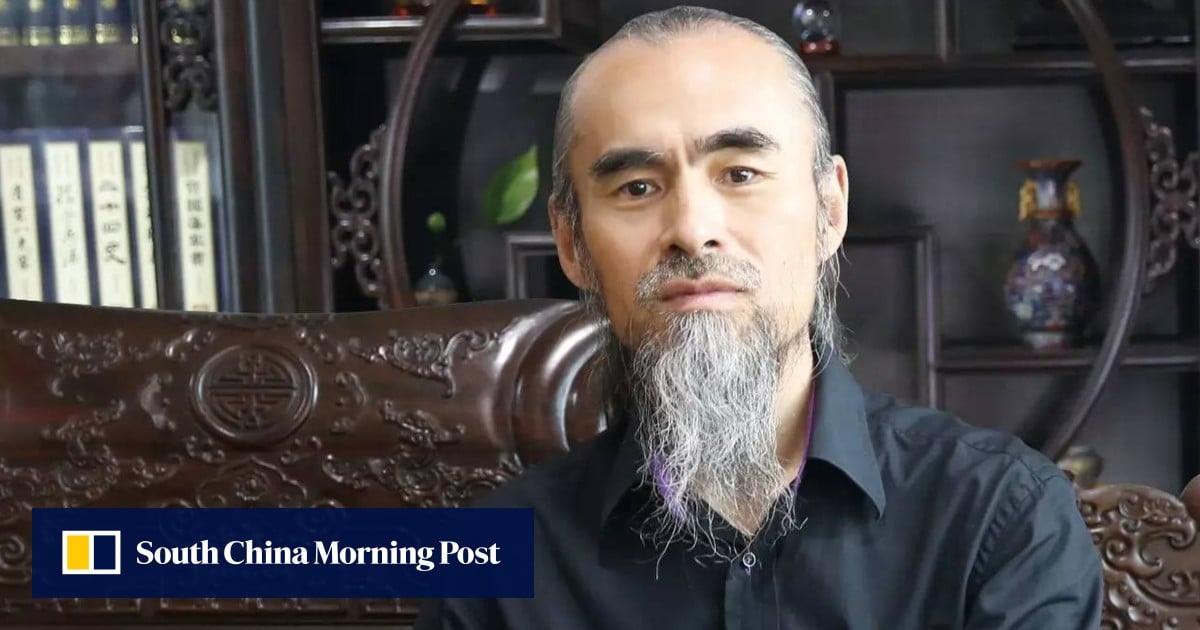

27 Feb Ding Yi Feng tanks in Hong Kong as market watchdog charges former chairman Sui Guangyi, 20 others with manipulating shares

Sui is Ding Yi Feng’s largest shareholder with a 22.26 per cent stake, according to the company’s interim report in 2023.

Ding Yi Feng said it is in consultation with its legal advisors regarding a “Writ of Summons” – an official order for an individual to show up in court after being accused of committing an offence – and will address the issue in another announcement when appropriate.

The SFC said it was seeking to “restore those affected to their pre-transaction positions” and prevent the defendants from disposing of any assets or property.

Ding Yi Feng tumbled as much as 32.6 per cent early in the morning session, before recovering some ground to trade 24.3 per cent lower at HK$1.09 just before noon. The stock has lost over 40 per cent so far this year.

The company’s net profit amounted to HK$97 million (US$12.4 million) for the six months ended June 2023, compared with a loss of HK$272 million a year earlier, according to last year’s interim report.

Founded in 2001, Ding Yi Feng describes itself on its website as using “classical eastern philosophy” to guide its investment decisions. It was once the top performer on the MSCI’s global stock index, rallying 8,500 per cent between the mid and late 2010s before the SFC launched its probe against the company in 2018.