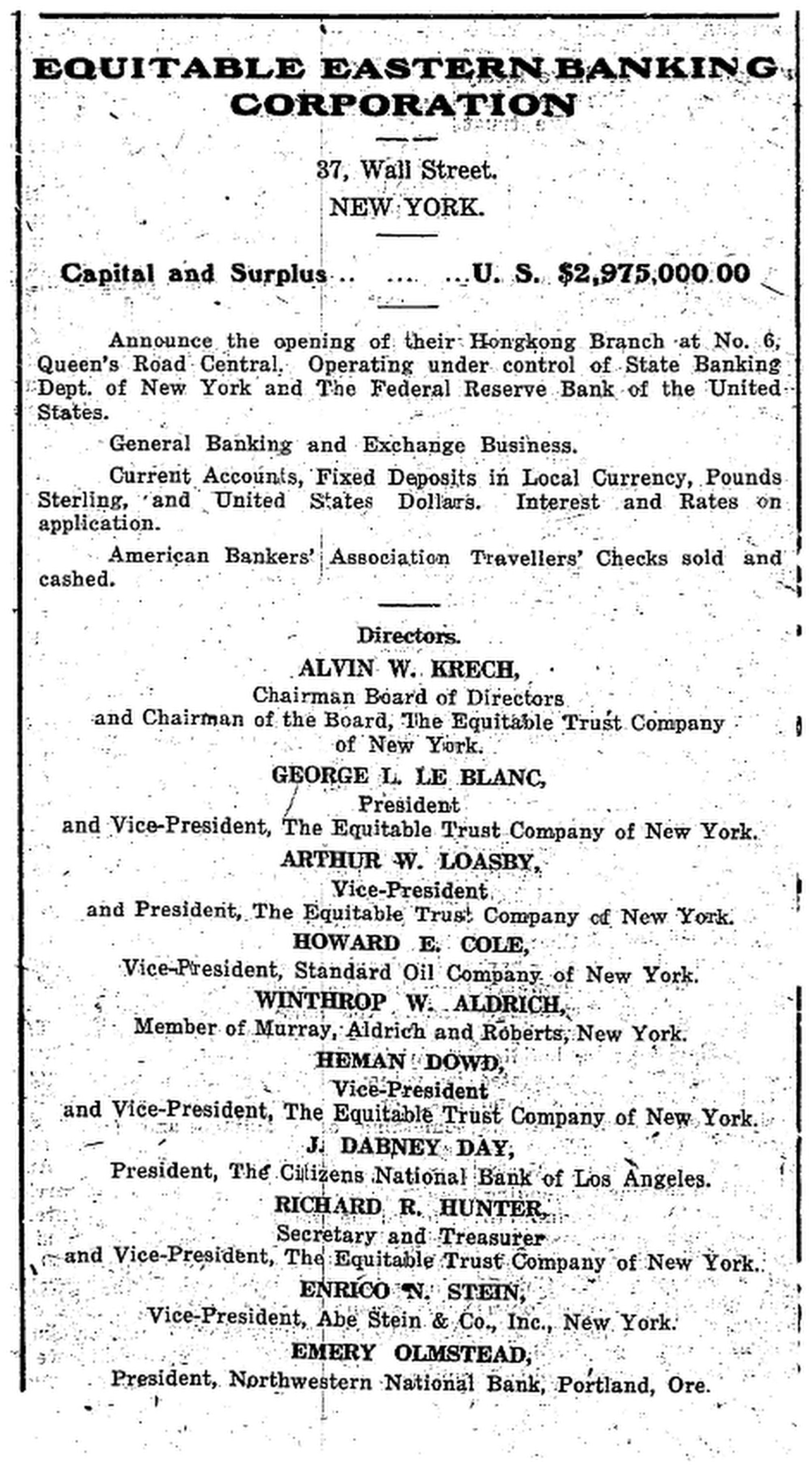

13 Mar Exclusive | JPMorgan’s faith in Hong Kong as financial hub as strong as ever a century on, COO Daniel Pinto says

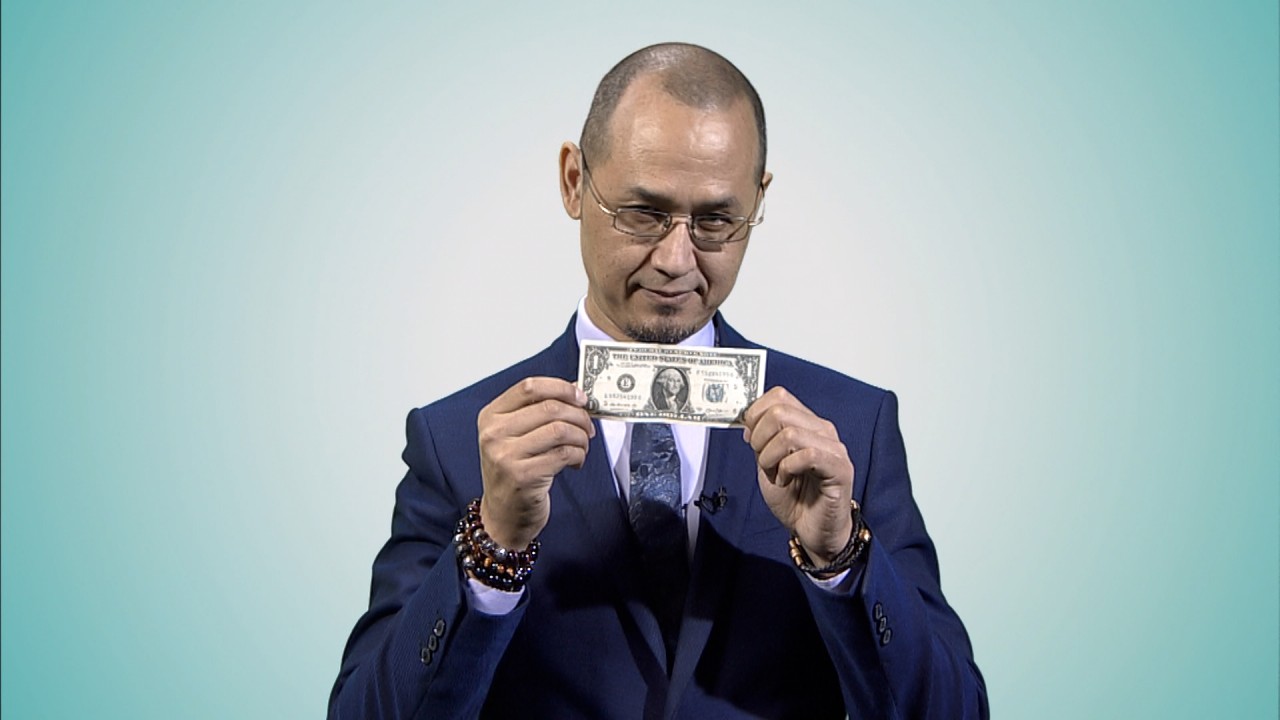

“We will continue to do the business that we are doing and continue growing,” said the bank’s president and chief operating officer Daniel Pinto during an interview in Hong Kong. “We are not the type of company that is going to go fully in one day and fully out the other. These are [business] cycles, and we’ve been navigating cycle after cycle over time.”

JPMorgan, which oversees assets of US$2.6 trillion, said it would continue hiring in China for its asset management business. Last year, the company took full ownership of China International Fund Management, its asset management arm in the mainland.

“China is the second biggest economy in the world and it will create opportunities, how fast or how slow those opportunities will present themselves is a matter of being prudent in that part of the cycle,” said Pinto.

The firm, which employs some 320,000 people worldwide, has been picking up talent at a time when most banks have been making cuts. Over 80,000 members of staff are based in its Asia offices.

Pinto declined to specify the bank’s headcount in Hong Kong and on the mainland.

Good returns led to further investments across the board, in areas such as payment products, retail business, digital retail outside the United States, and wealth management.

But there is still room to grow, according to Pinto, because the bank’s mainland business is clearly “disproportionate” to the size of mainland China’s economy, he said, adding that Hong Kong will continue to be part of the growth.

“The potential for growth in China is significant, if it is possible to monetise,” he said. “[Hong Kong’s government] needs to maintain the environment to continue to be a global financial centre in the world and create an environment for foreign companies and local companies to continue to evolve.”

To mark its centenary, JPMorgan is organising a year-long calendar of events for its staff and customers, culminating in a 5.6-kilometre charity run on November 21 at the West Kowloon cultural district.

The activities in Hong Kong coincide with the local government’s efforts to woo international investors back to the city by hosting three major events this month, including the Wealth for Good in Hong Kong Summit, and the inaugural One Earth Summit.

JPMorgan has no plans to back out because of geopolitical tensions, according to Pinto.

“[Geopolitical] tensions go up and down, based on how much dialogue there is or there isn’t. When Biden and Xi met in San Francisco and agreed on military dialogue and the importance of the commercial relationship between the countries then the tension went down,” he said.

The company plans to continue to be strategically invested in China, because you cannot “ignore the second biggest economy in the world. Because for any company and in any industry, once you’re out, it’s very difficult to go back in,” said Pinto.