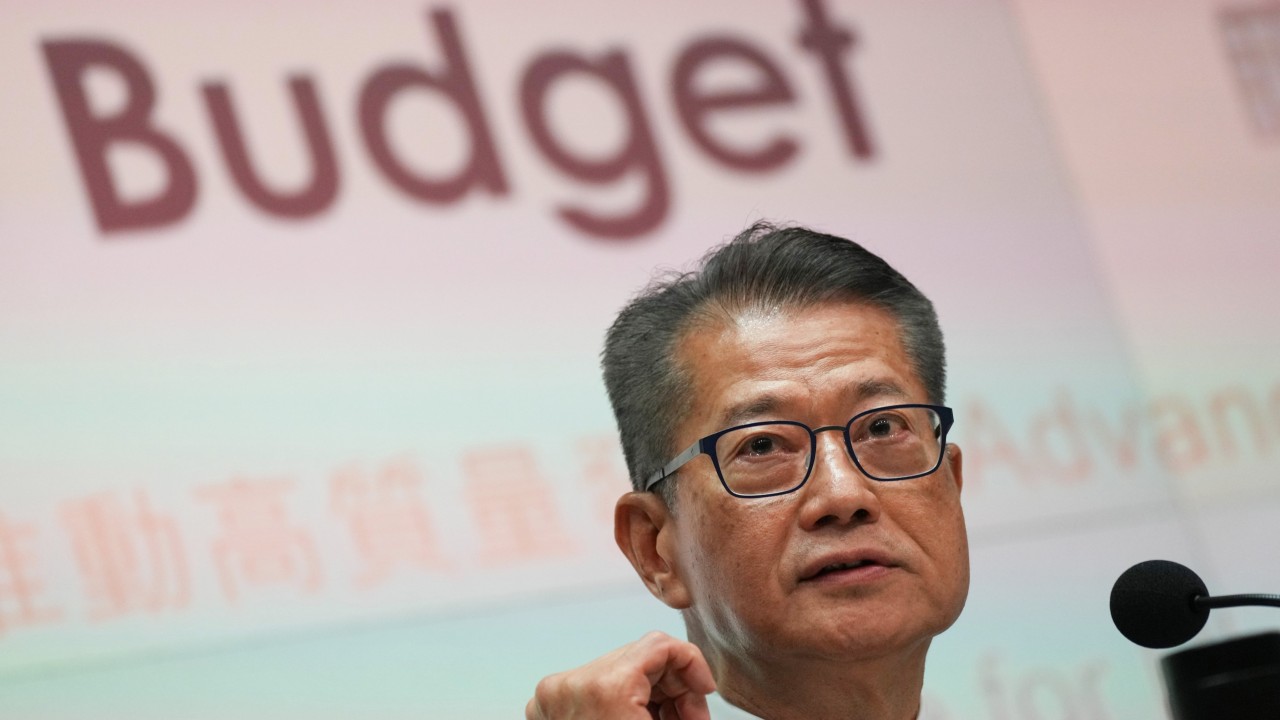

29 Feb Hong Kong budget: Paul Chan has pulled all stops, but has city done enough to secure asset and wealth management hub status?

Chan said the city will enhance the preferential tax regime for related funds, single-family offices and carried interest, and will review the scope of Hong Kong’s tax concessions regime, increasing the types of qualifying transactions and enhancing flexibility in handling incidental transactions.

Hong Kong to improve tax breaks to lure more foreign funds, family offices: Paul Chan

Hong Kong to improve tax breaks to lure more foreign funds, family offices: Paul Chan

“If the changes to the UFE and the carried interest incentives are in line with the industry’s expectations and provide the certainty to managers that there is no tax leakage at the fund level, which is the case in other comparable jurisdictions, then it really does make Hong Kong a very attractive and viable asset management hub,” said Bowdern, who is also vice-chair of the Hong Kong Venture Capital and Private Equity Association’s technical committee.

Additionally, while the government is expanding the scope and capacity of several mutual-market access schemes between mainland China and Hong Kong, some pain points and friction remain unresolved. For instance, certain cross-border proactive marketing and sales activities are prohibited under the Wealth Management Connect scheme’s rules.

Hong Kong’s star shines as Greater Bay Area’s rich tap tax breaks, incentives

Hong Kong’s star shines as Greater Bay Area’s rich tap tax breaks, incentives

Market participants have applauded the new Capital Investment Entrant Scheme (CIES), better known as the investment-migration scheme, which will soon accept applications from eligible investors to “live in and pursue development in Hong Kong”, according to the financial secretary.

Wong said the measure will be key to driving the fund management industry because it can expand the investor base for funds, insurance products and other financial products offered in Hong Kong.

“It will raise the brand awareness of Hong Kong Inc, in particular showcasing the breadth and depth of the financial product offerings of Hong Kong,” she said. “Fund managers are fully geared up for the launch and eagerly await the announcement of the details.”

Hong Kong’s investment-migration plan to provide ‘big boost’: official

Hong Kong’s investment-migration plan to provide ‘big boost’: official

“Whilst removing red tape and making the re-domiciliation process easier certainly helps, fund sponsors still need a tangible and compelling reason to make the move in the first place,” said Helen Wang, counsel in the corporate and securities practice at Mayer Brown.

Wang was referring to a government grant scheme for OFCs, which will expire in May but will be extended until 2027. Newly incorporated or redomiciled OFCs can receive a grant of up to HK$1 million (US$127,764) to cover their expenses.

Market participants have, however, long advocated for a re-domiciliation mechanism for funds and companies, according to KPMG’s Bowdern.

The proposed mechanism will allow companies to bring assets and operations back to Hong Kong without requiring a formal transfer, or a liquidation of offshore firms.

“Lots of efficiencies and savings can be achieved from this new proposal,” Bowdern said. “It also puts us in a competitive position with other similar asset management hubs.”

Hong Kong’s financial watchdog aims to raise global appeal of city’s markets

Hong Kong’s financial watchdog aims to raise global appeal of city’s markets

There are more than 250 OFCs and 780 LPFs registered in Hong Kong. The city is also aiming to attract at least 200 family offices by 2025, on top of the nearly 400 such firms already here. Meanwhile, Singapore had 1,194 licensed and registered fund management companies and 1,100 family offices, as of the end of 2022.

While the Lion City has an edge when it comes to attracting clients concerned about US-China tensions, Hong Kong has advantages when it comes to attracting mainland China’s wealth through its cross-border financial infrastructure.

“There are things we cannot control, such as geopolitics,” said HKIFA’s Wong.

“We should instead focus on controllable factors, and build up on our unique advantages. Connect schemes are unique to Hong Kong and if there are further relaxations, these will greatly reinforce Hong Kong’s position as a fund management centre.”