15 Apr Shanghai is the sole commodities bourse to stay open to Russian aluminium, copper and nickel as sanctions drive Moscow towards China

Sanctions by the United States and the United Kingdom on Russian metals will cement China as Moscow’s buyer of last resort for key commodities, and enhance Shanghai’s role as a venue to set prices for materials crucial to the global economy.

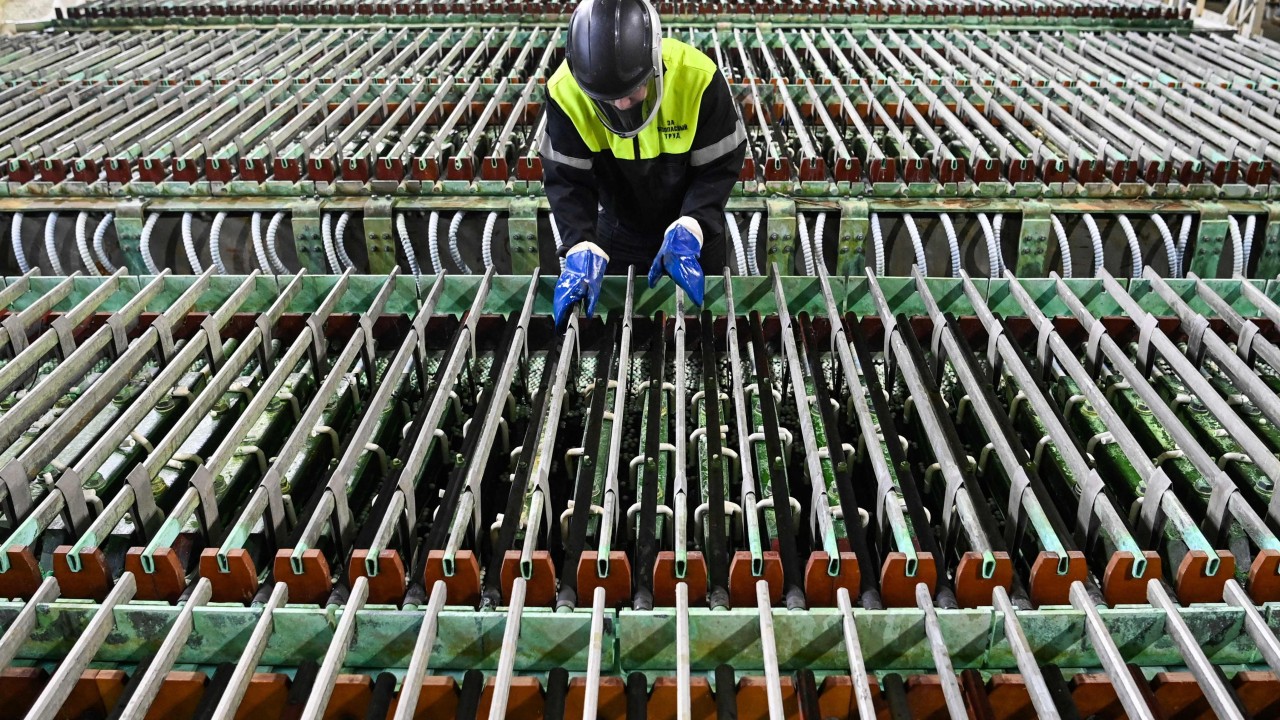

The London Metal Exchange’s ban on newly produced Russian aluminium, copper and nickel is likely to drive Chinese imports even higher. It also leaves the Shanghai Futures Exchange as the only major commodities bourse in the world to accept Russian shipments of the three metals.

“The liquidity of Russian metals in European and American markets may further decline, and global trade flows will also be reshaped,” said Wang Rong, a senior analyst at Shanghai-based broker Guotai Junan Futures.

Energy market sanctions imposed on Moscow in the wake of its invasion of Ukraine have already had a dramatic impact on China’s buying habits. Russia leapt above Saudi Arabia to become the biggest source of Chinese crude oil imports last year. It is also now No. 2 for coal and is likely to become Beijing’s biggest supplier of natural gas this year.

Can HKEX-owned LME rebuild its reputation a year after nickel chaos?

Can HKEX-owned LME rebuild its reputation a year after nickel chaos?

Even without formal sanctions, China’s imports of Russian aluminium have hit record levels. Russian aluminium giant United Rusal International generated 23 per cent of its revenue from China last year, compared with just 8 per cent in 2022. Rusal has also taken a 30 per cent stake in a Chinese alumina plant to plug a gap in supplies of the key ingredient amid disruptions triggered by the war in Ukraine.

The new sanctions will push more exports of Russian metal to countries outside US and UK jurisdictions, especially China, according to Guotai Junan. The extra supply will also encourage the export of metals produced in China as more material pools within its borders, the broker said in a note. China is the world’s biggest producer of refined copper and aluminium and a major player in nickel via investments in Indonesia.

State-owned firms surge as China’s watchdog pledges market improvements

State-owned firms surge as China’s watchdog pledges market improvements

Chinese importers have taken advantage of Beijing’s strategic alliance with Moscow to win discounts on key raw materials, paying in yuan to bypass the dollar, the currency in which trades are usually settled. That helped the world’s biggest commodities buyer stave off the inflationary impact of the war in Ukraine, as well as advancing Beijing’s desire to unseat the US dollar as the world’s reserve currency.

But more Russian shipments becoming available at a time when China’s economy is so sluggish presents its own problems. Chinese metals traders struggled last year with weak demand and the green shoots of recovery in markets for items like copper are relatively recent.

The prospect of additional Russian supplies heading to China widened the spread between London and Shanghai metals in early trade on Monday. While LME aluminium spiked as much as 9.4 per cent, the reaction on SHFE was more muted, with the rise in price capped at 2.9 per cent compared with Friday’s close.

Ukraine crisis: Chinese oil, mining groups are early stock market winners

Ukraine crisis: Chinese oil, mining groups are early stock market winners

The discrepancy could partly be due to traders closing both LME short positions, or bets that prices would fall in London, and long positions on SHFE – bets they would rise in Shanghai – to stem losses from a so-called reverse arbitrage trade, said Harry Jiang, head of trading at Yonggang Resources.

Instead, the uneven increases in price are shutting the door on Chinese imports of aluminium priced in dollars. That could make Russian metal, if priced in yuan and offered at a discount, more attractive.

China has long sought greater pricing power over global commodities given its hefty reliance on imports. How that plays out for the Shanghai exchange is complicated by the new sanctions rules, which will allow old Russian metal to continue to be delivered to the LME, the world’s benchmark, as well as to the Chicago Mercantile Exchange, the premier exchange in the US.

The world’s second-largest economy started the year on solid footing, as China’s factories revved up. Analysts warn that growth will be tough to maintain without broader improvement.

An unprecedented squeeze in the market for copper ore has fired up bullish investors and helped drive prices to the highest in nearly two years.