20 Mar Tech war: Chinese chip executives put faith in global cooperation despite intensifying US restrictions

Chen also serves as chairman of the China Semiconductor Industry Association, a 744-member trade group.

“China’s semiconductor market belongs to the world, while the world’s semiconductor market also belongs to Chinese companies,” Chan said. He added that speeches made previously by Huang convinced him about the future of the global semiconductor market, which Semicon China projected will top US$1 trillion by 2030 on the back of AI-related chip demand.

Nvidia developed three new data-centre graphics processing units – the H20, L20 and L2 – specifically for Chinese customers after its A800 and H800 GPUs, tailor-made for Chinese clients to comply with an earlier version of US export controls, were banned from being sold to China in October.

Neither Nvidia nor Huawei are taking part in this year’s edition of Semicon China.

New developments in AI and electric vehicles will boost demand for chips, with global semiconductor sales expected to grow between 13 to 16 per cent this year to reach around US$600 billion after an 11 per cent drop last year, according to Ju Long, president of Semicon China.

Global sales of semiconductor equipment dropped by a lower-than-expected 1.9 per cent last year, thanks to a 28 per cent jump in demand from China to US$36 billion, Ju said.

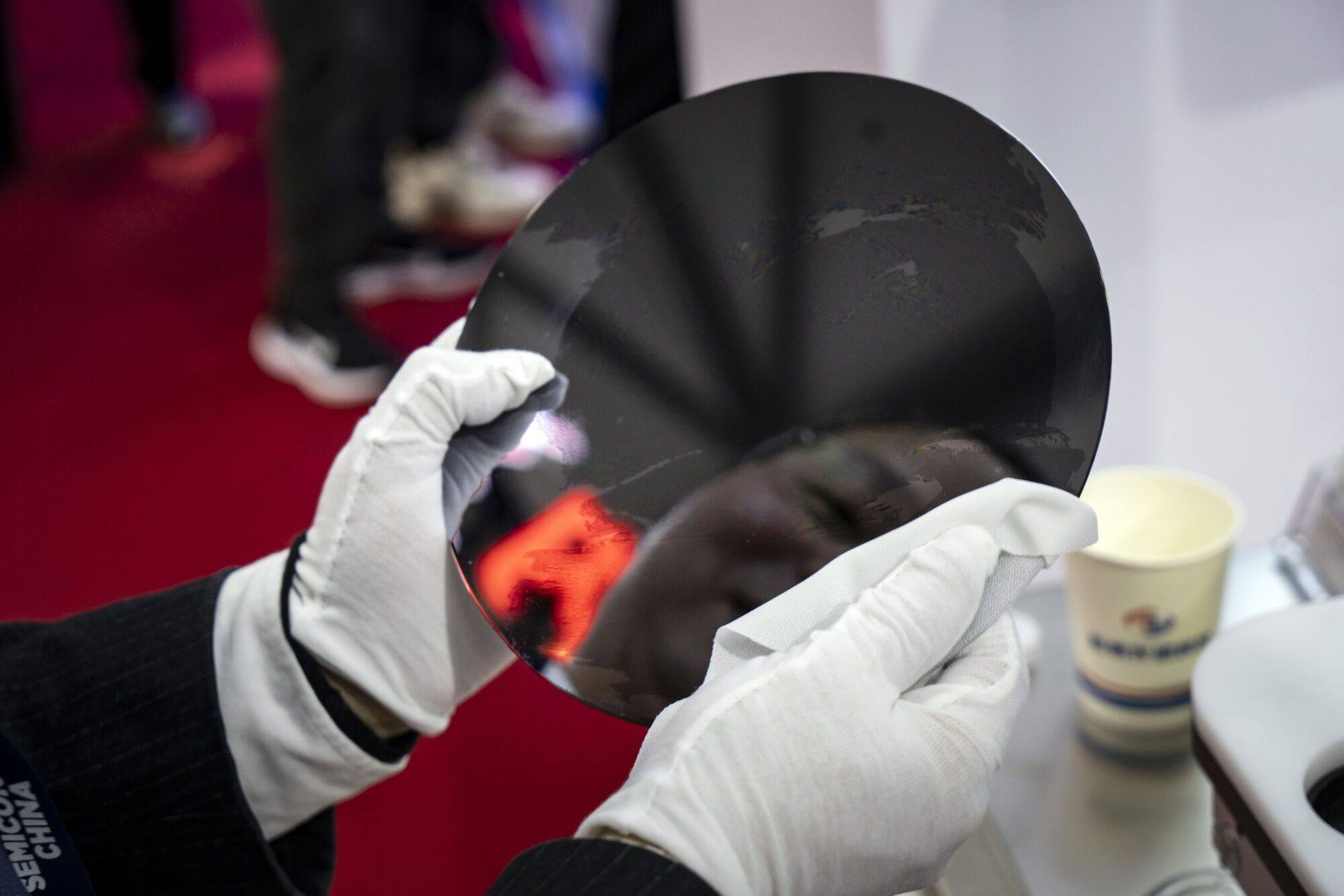

China, the world’s largest semiconductor market, relies heavily on imports to meet its demand for advanced chips, tools and software, making the country vulnerable to US sanctions.

However, none of the keynote speakers directly mentioned US sanctions or their impact on China’s chip industry.

This year’s Semicon China has brought together more than 1100 exhibitors, most of domestic companies, according to the official list of participating firms.

Semiconductor Manufacturing International Corporation, China’s top foundry, is not an exhibitor this year despite being based in Shanghai.